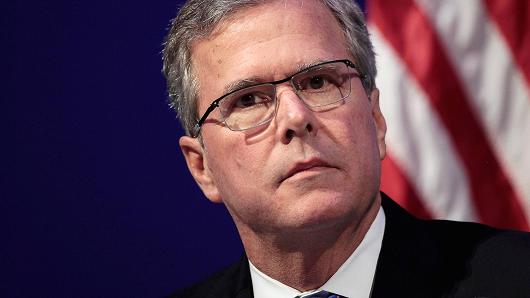

Republican presidential candidate Jeb Bush is advancing a tax plan that would put a cap on the mortgage interest deduction and completely eliminate the deduction for state and local real estate taxes, effectively raising taxes on tens of millions of homeowners.

The mortgage interest deduction, along with deductions for state and local real estate taxes, are considered by many to be a third rail in politics. This deduction saved homeowners about $70 billion in taxes in 2013, according to the Joint Committee on Taxation.

Bush’s plan would limit itemized deductions sharply, capping them at 2% of adjusted gross income, and that would include the mortgage interest deduction.

Bush would also eliminate the deduction for state and local taxes entirely.

These measures would effectively raise taxes on tens of millions of homeowners nationwide.

Of the $54 billion a year the overall cap would raise in revenues under the Bush tax plan, about $46 billion comes out of the mortgage interest deduction, analysts say.

The real estate industry, from lenders to agents and most every segment between, have vehemently opposed any reduction, limit or cap on the mortgage interest deduction because of its potential negative effect on homeownership. Most trades including the National Association of Realtors are on record strongly opposing any cut.

However a number of advocates favor phasing out or cutting the mortgage interest deduction.

The Bush plan is being criticized as a warmed-over version of Mitt Romney’s 2012 tax plan, which garnered little support among conservatives.

Bush is currently struggling in the polls, falling in the most recent New York Times/CBS poll from 13% to 6%. Worse for the one-time frontrunner, a new Florida poll conducted by Public Policy Polling shows that only 40% of voters in his home state think Bush should keep running, compared to 47% who think he should drop out.

From an industry perspective, even if the bulk of the industry would oppose Bush’s plan, there is at least the bright spot that more candidates are talking about housing policy.

On Oct. 16, a number of political candidates and some major players in the real estate finance and investment space will gather for the New Hampshire Housing Summit sponsored by the J. Ronald Terwilliger Foundation for Housing America’s Families.

HousingWire serves as the media partner for this gathering of minds at St. Anselm College. For more information, click here.

Current presidential candidates who will be attending include Republicans Gov. Mike Huckabee and Sen. Lindsey Graham, as well as Sen. Scott Brown, Kelly Ayotte, former Housing & Urban Development Sec. Henry Cisneros, former Federal Housing Finance Agency Commissioner Nic Retsinas, former Rep. Rick Lazio, Mortgage Bankers Association President and CEO David Stevens, American Bankers Association President and CEO Frank Keating, and Habitat for Humanity Chairman Renee Glover.

Organizations attending the summit span the gamut of perspective and interest, and include Enterprise Community Partners, the National Low Income Housing Coalition, the Urban Institute, the Federal Deposit Insurance Corp., the Federal Home Loan Banks, the American Enterprise Institute, Bank of America, and a number of housing authorities, advocates, think tanks and businesses.