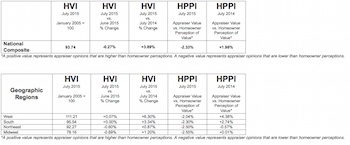

Appraiser opinions of home values were 2.33% lower than homeowner estimates in July, according to the Quicken Loans national Home Price Perception Index.

The gap between homeowner estimates and appraiser opinions of value in July was nearly double the gap between these values in May.

“Many homeowners around the country are seeing the national headlines about home value increases and they are optimistic about their equity increasing,” said Quicken Loans Chief Economist Bob Walters. “While some areas are seeing the same level of home appreciation, or even more, there are also some areas that have slower home value increases. This can lead to homeowners and appraisers not quite seeing eye-to-eye.”

(Source: QuickenLoans)

Homeowners are increasingly overvaluing their homes, according to the national HPPI. The study showed appraisers’ opinions of home values was, on average, 2.33% lower than homeowners’ estimates in July.

Last month’s gap was nearly double the difference between opinions in June when appraisers’ opinions were 1.40% less than homeowners’ estimates.

“A slowing of home value increases adds to the misunderstanding of local home values,” Walters continued. “Appraisers are viewing the housing industry every day; they know when home values growth may be slowing. Homeowners may think values are still skyrocketing, when they have instead returned to more healthy appreciation in their area.”

Home values across the nation continue to rise above last year’s levels, although they are practically flat on a monthly basis. The HVI reported national values decreased 0.27% from June to July, but increased 3.89 since last July.