Amid stabilizing U.S. home price growth lies a demographic shift that is underway across much of the country, according to Fitch Ratings in its latest quarterly U.S. RMBS Sustainable Home Price Report.

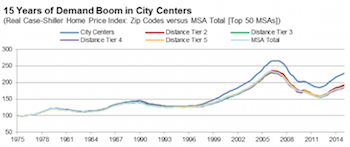

Significant demand is returning to city centers following decades of suburban and exurban growth. Since 2000, home prices have grown 50% faster in urban centers than in the broader MSA areas, with population growth trends beginning to favor city centers as well.

‘This demand shift implies that city centers will continue to see growth even where regional prices have been stagnant, such as Atlanta or Chicago,” said Fitch Director Stefan Hilts.

(Source: Fitch Ratings)

This trend is clear in nearly every city analyzed, but seems to be particularly strong amongst growing mid-sized markets, including Nashville, Denver, Portland, and Cincinnati. With increased preference for urban living, one implication going forward is ‘the likelihood for home ownership rates to remain persistently low and declining as more potential buyers opt to live in cities where rentals dominate,’ said Hilts.

With continued upward economic pressure and the pace of price growth slowing in many cities, Fitch’s model shows declines in overvaluation for a number of cities across the country.

Compared with a year ago, 186 of the 379 cities analyzed are less overvalued, with the median city now 2% undervalued and only 12% of markets more than 10% overvalued. Still, some booming cities such as San Francisco continue to see prices skyrocket. Nationally, prices are 1.4% overvalued.

This shift in demand comes amid a high level of sustainability nationally, with the median city now 2% undervalued, and only 46 markets more than 10% overvalued.

There is also evidence of price moderation in the Texas MSAs, including Houston, Austin, and Midland, which have been amongst the most overvalued in Fitch’s recent reports.

This change has a number of drivers and generates several long-term implications in the housing market, including the likelihood for home ownership rates to remain below their previous peaks, as more potential buyers opt to live in cities where rentals dominate. In this report, Fitch takes a deeper dive into these price differences and the long-term implications of the demand shift back to cities.